Independent Research

“The Buck Stops Here” – Harry Truman

It is not enough that the Securities Valuation Office categorizes credit risk (NAIC 1 – 6) – this is after the fact.

Limitations of common sources of research include:

- Issuer-Paid NRSROs – Nationally Recognized Statistical Ratings Organizations (NRSROs) – Moody’s, S&P, Fitch, among others have recently been called into question regarding their objectivity. While a timely and broad resource, it is not sufficient to rely on these providers to fully vet a debt issuance.

- Fee-Based Credit Rating Providers – Are suitably objective; however, their coverage sometimes lacks the breadth necessary to sufficiently insulate the insurer from credit risk.

- Sell-Side Research – While the price is right, desk research pieces lack the objectivity necessary and are frequently slanted to produce a transaction. Frequently the work of credible anlaysts and a source of information, the limitations are obvious.

- News Headlines and Notices – While they’re timely, they lack consistency and depth of understanding. Worse, once it hits teh news, it’s too late.

Ideally, the credit research effort should be:

- Independent – Dedicated exclusively to the insurer

- Broad – A vast body of work; drawing from broad resources

- Focused – Only the topics of importance to the investor should be analyzed

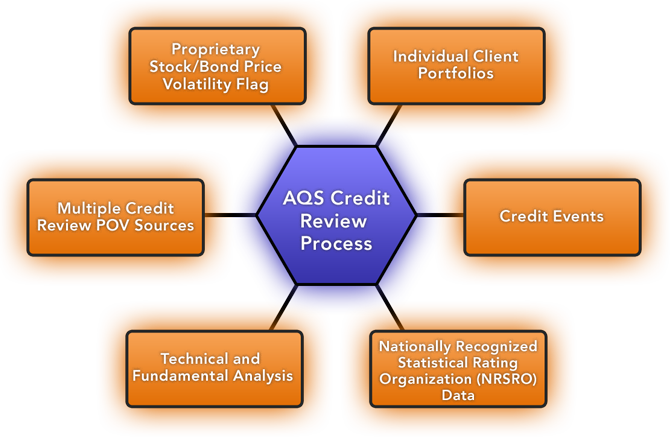

AQS is particularly adept at drawing from multiple credit resources, verifying the information separately and providing a succinct analysis of the risk versus reward. Most importantly, our research team provides a recommendation in the context of the insurer’s portfolio – the real impact on the insurer’s bottom line.

An example of our research here