Insurance Focus

AQS Manages Investment Portfolios for Insurers Exclusively

Founded in 2004, AQS Asset Management, represents the confluence of technology, asset liability management and financial engineering to insurers. A deep understanding of capital markets enables AQS to source, vet and position ‘insurance-friendly’ assets that produce the yield necessary to compete.

AQS Trailing Reinvestment (as of 12/27/24)

| Days | Book Value | Yield | Mod | Eff | NAIC 1/2 |

|---|---|---|---|---|---|

| 360 | $468,233,508 | 6.54% | 3.30 | 3.40 | 79% / 21% |

| 180 | $240,985,839 | 6.45% | 3.20 | 3.30 | 80% / 20% |

| 90 | $129,411,151 | 6.18% | 4.10 | 4.10 | 82% / 18% |

Asset Classes and Strategies

Fixed Income markets are constantly evolving, creating opportunity. AQS embraces this evolution to create security and produce competitive yield.

Investment Grade Fixed Income

The liquidity and structure of Investment Grade or “IG” bonds cause them to remain the core of most insurer portfolios. How IG bonds perform in the context of insurer liabilities requires a solution specific to the insurer. Common textbook strategies like laddering, duration matching and indexing fall short. AQS has engineered the process that takes structure to the bottom line.

Structured Securities

Structured securities are more complex. Identifying and stressing structural risk is part of the problem. Understanding how this fits with liabilities and works for the bottom line completes the picture. As fixed income markets continue to evolve, embracing change and the opportunity it represents will be essential to a competitive portfolio.

Private Credit

Private credit or private placements offer the opportunity to negotiate directly with the company to establish important covenants. Unlike prior generations, many such issues today are held electronically at the custodian, have a public CUSIP and can be found on common fixed income databases. More importantly, private credit is well-documented to produce higher returns for similarly rated issuers.

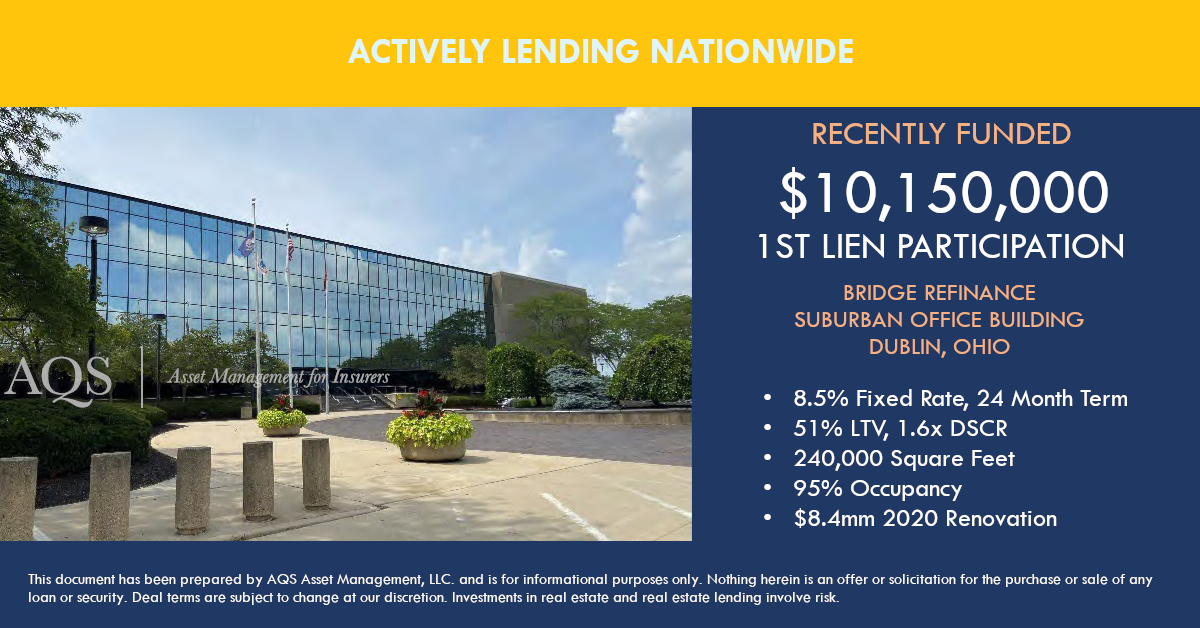

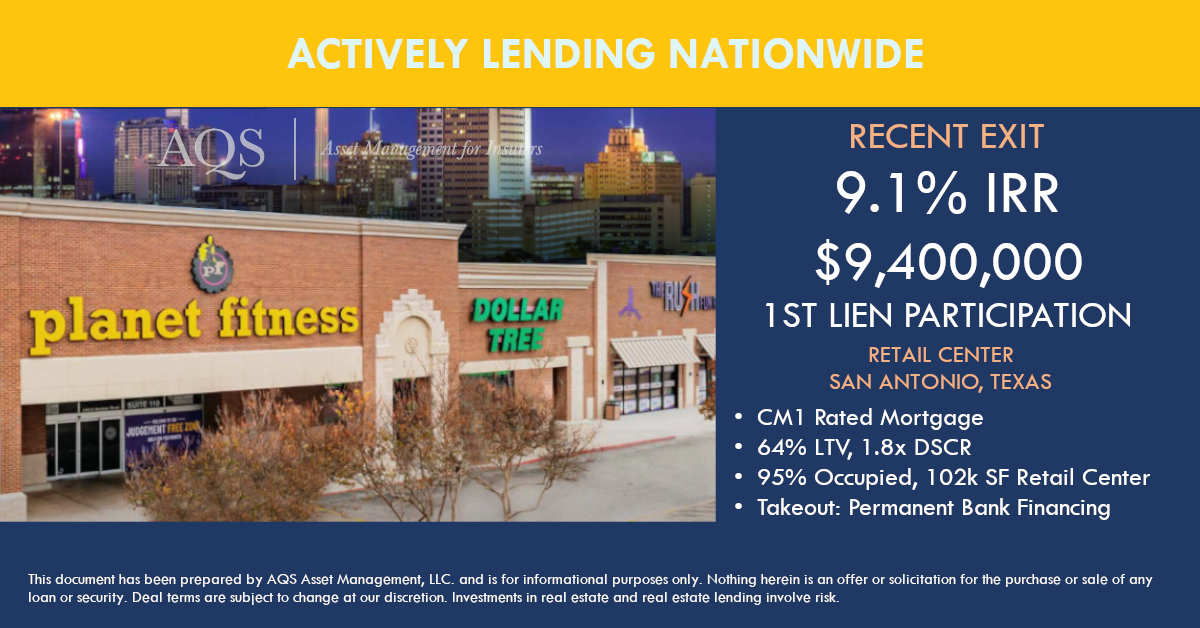

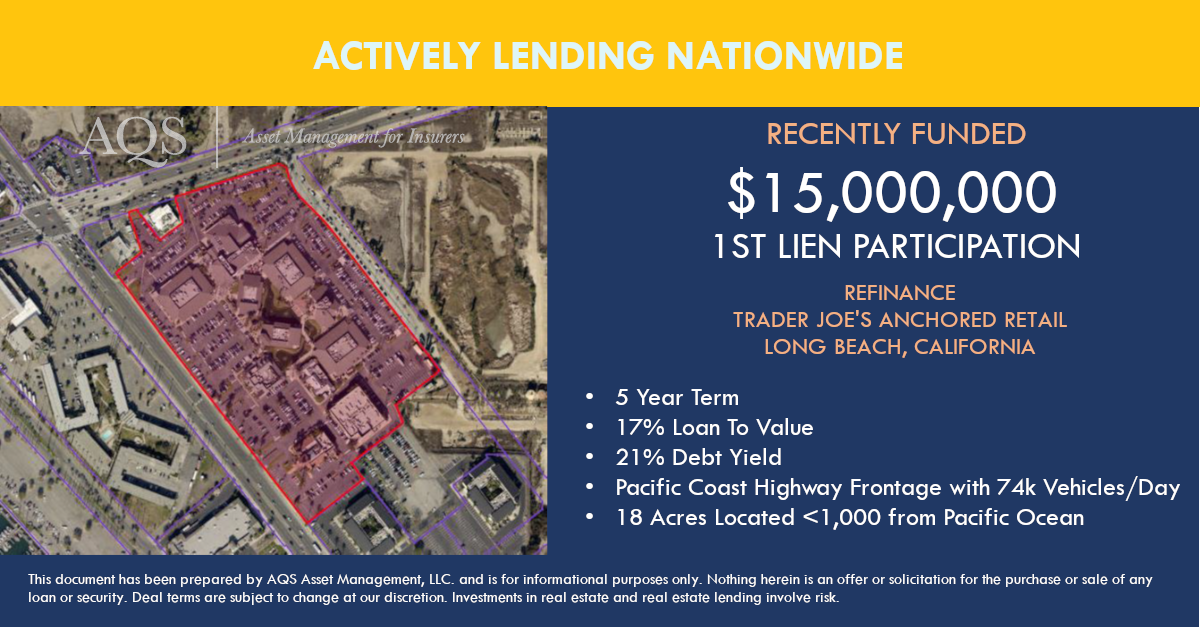

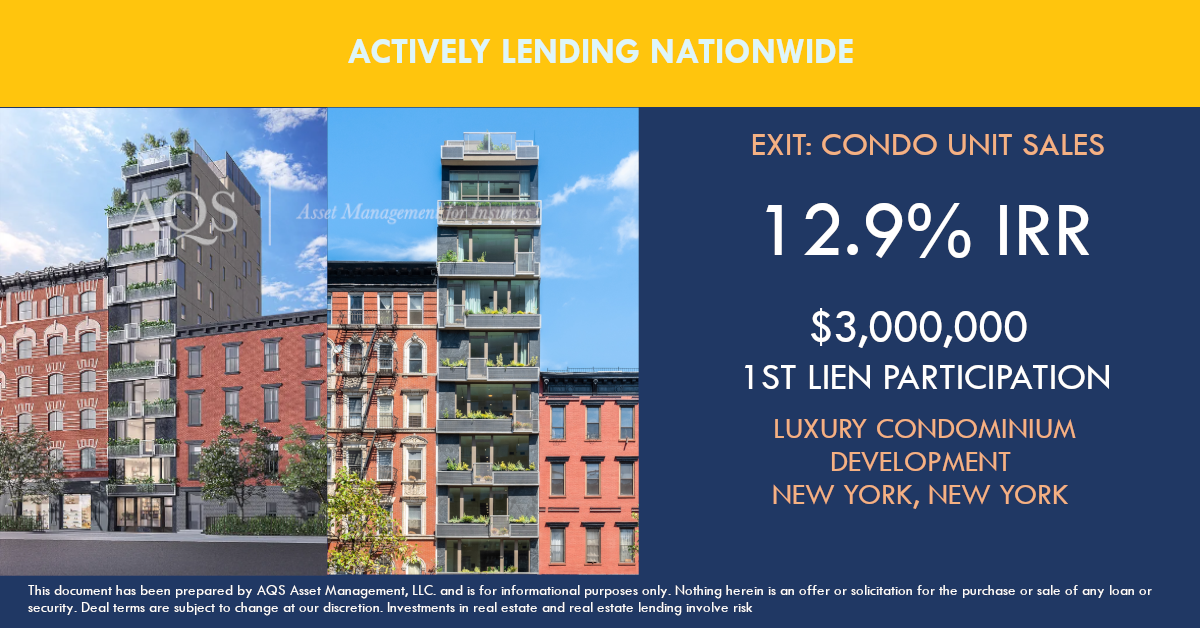

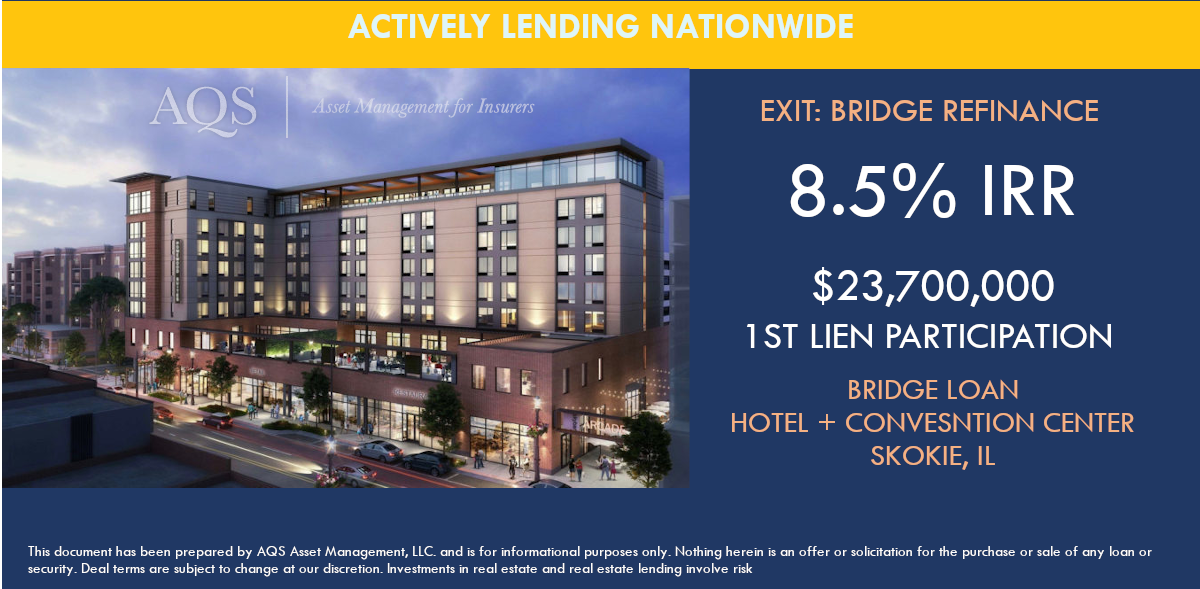

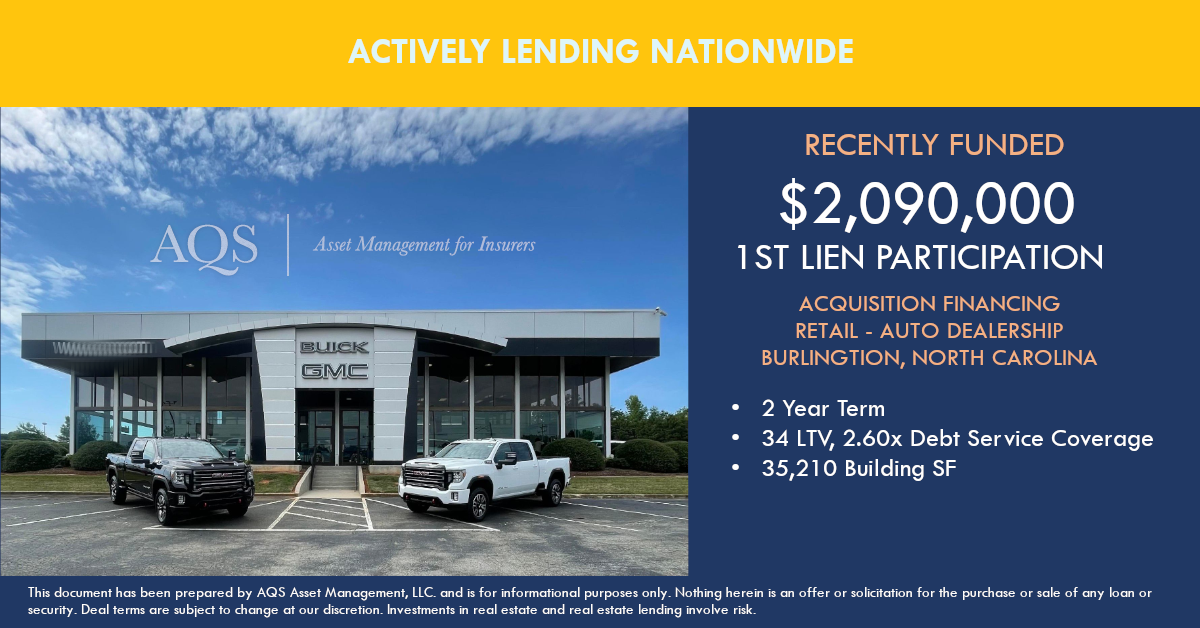

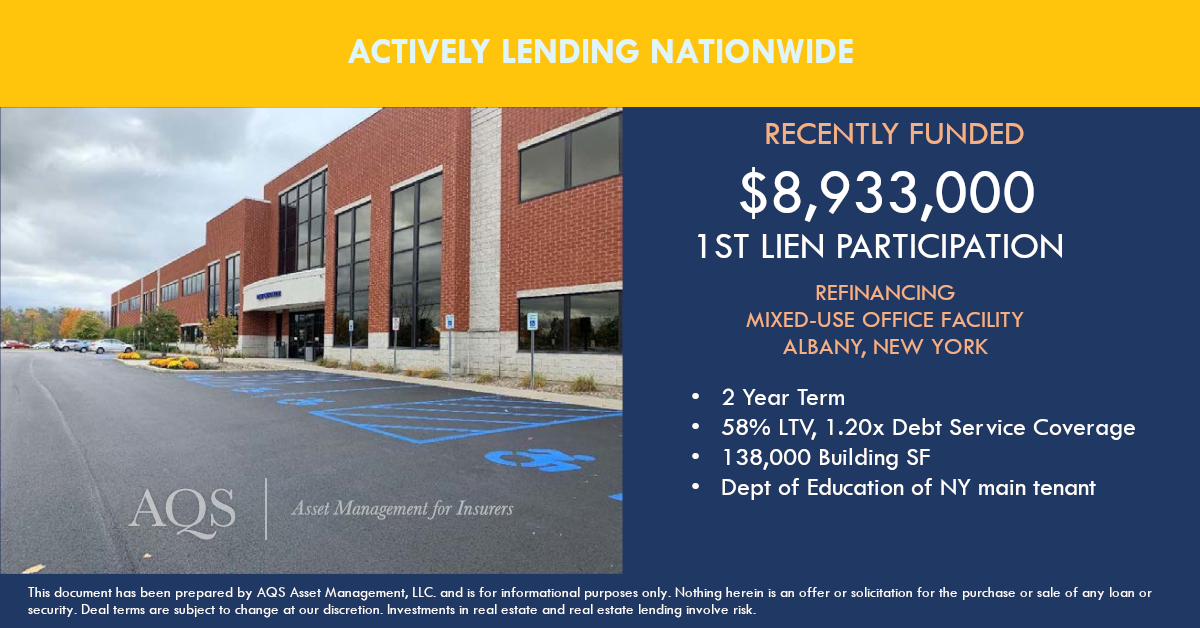

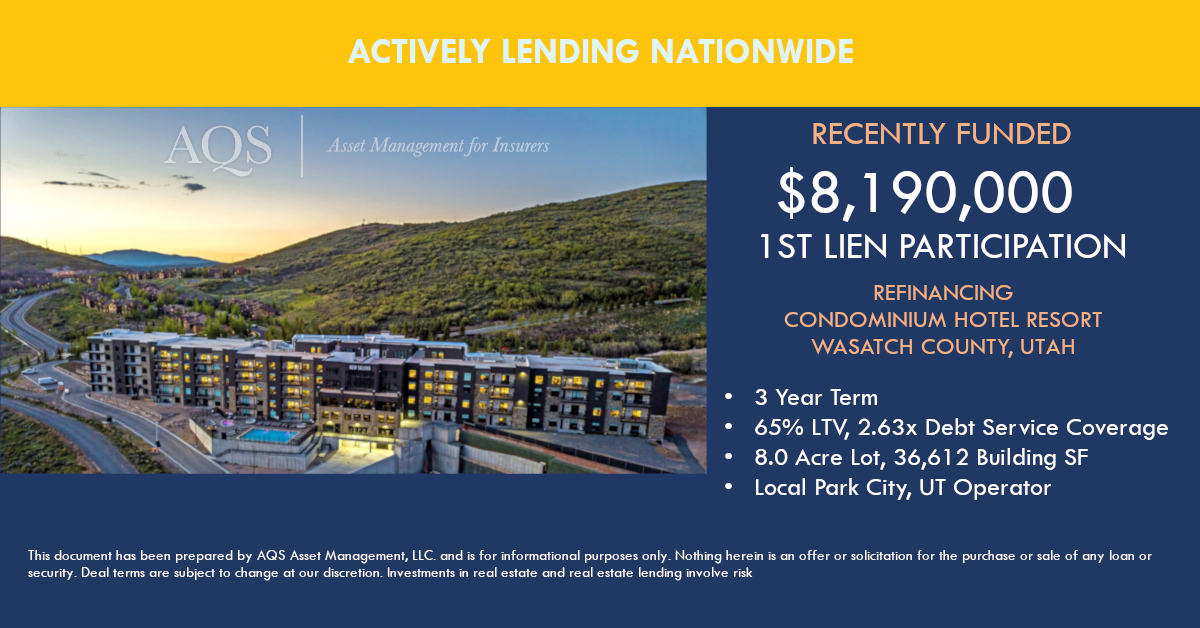

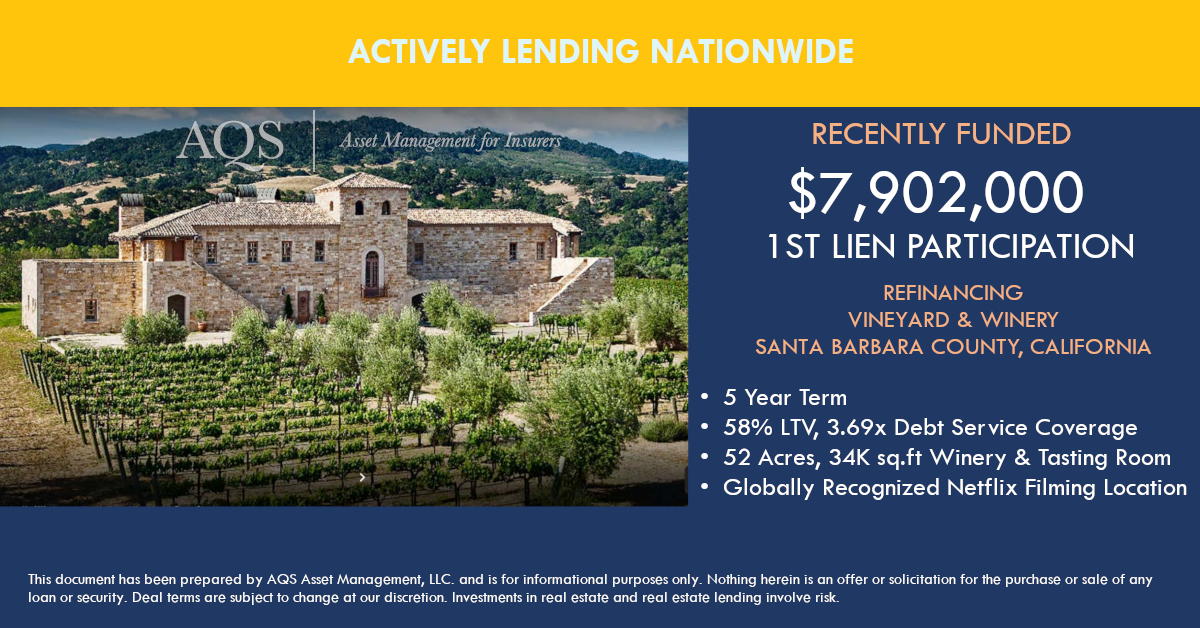

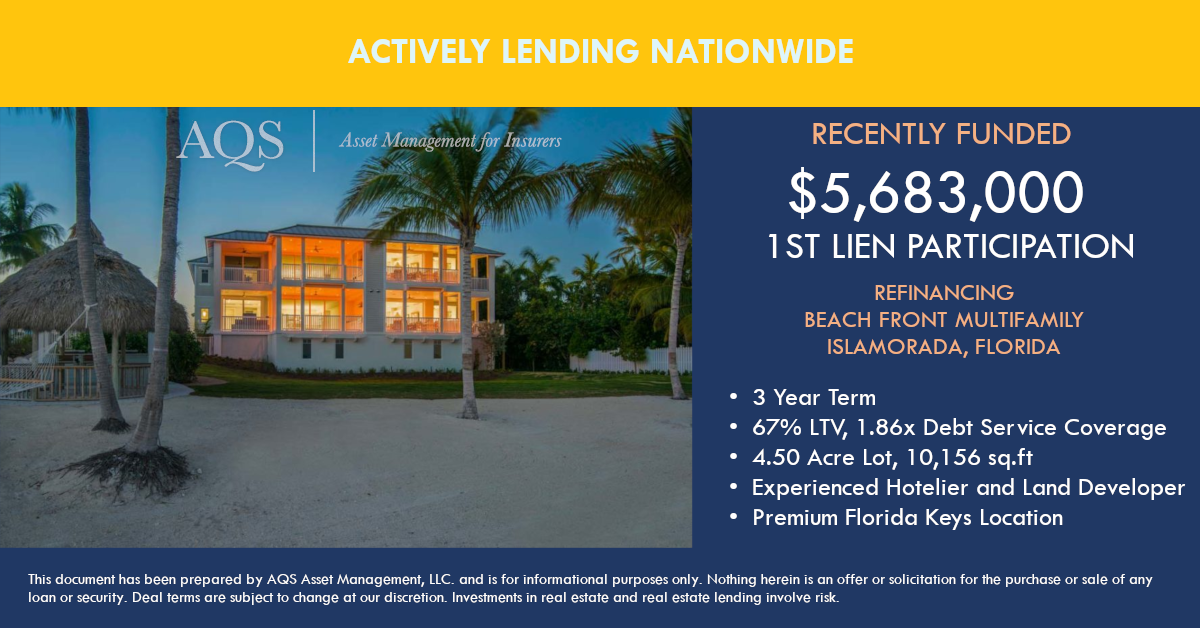

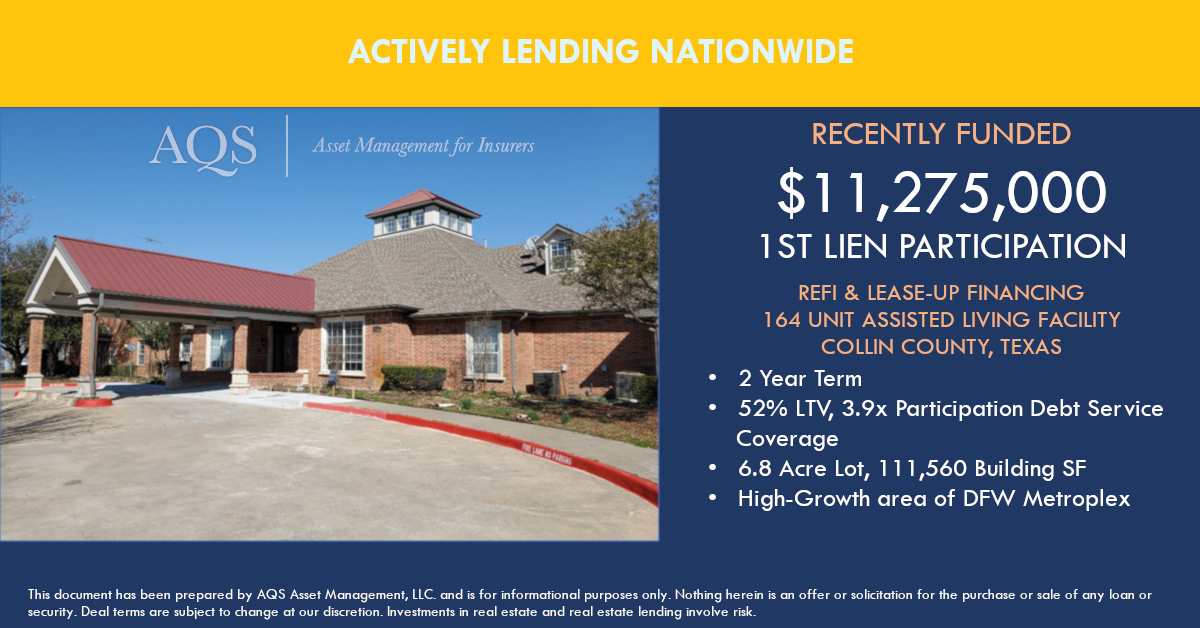

Commercial Mortgage Lending

Commercial mortgage lending is labor intensive requiring underwriting expertise, legal review and an understanding of competing asset classes. AQS has spent years developing the process we have today that combines the security of collateral, short maturity, yield, attractive risk weighting and transparency. Servicing and accounting is turnkey as well.

Equities

Equity exposure is best accomplished by a low-cost, passive strategy employing Exchange Traded Funds or ETFs. ETFs circumvent the need and expense that goes with an active management strategy which has historically underperformed. Liquidity and transparency devoid of single-issue speculation and the accounting baggage that goes with it.